Making sense of bitcoin ETF outflows

/The SEC’s decision to approve a handful of spot bitcoin ETFs in January was expected to buoy retail and institutional investor confidence in crypto-based financial products. To what extent has that prediction come to fruition?

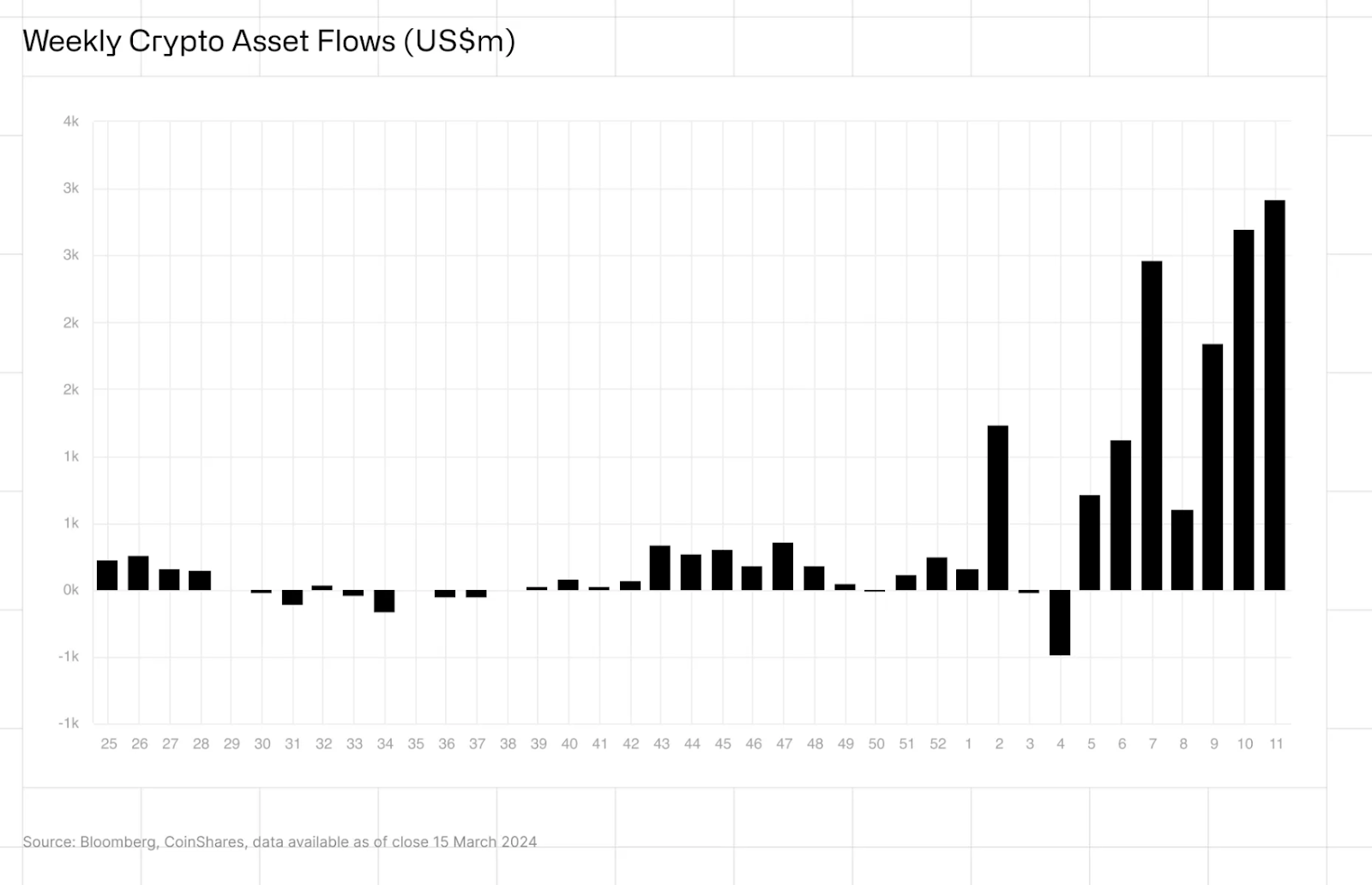

Rather than a rising tide that lifts all boats, the market-landscape development has begun to create pools of winners and losers. For one, a report by Coinshares suggests that, by March 15th, $13.2B of inflows have gone to investment products like spot bitcoin ETFs, meaning more than $74.61B in bitcoin is now under custody. Bitcoin has emerged as a definitive winner on this front, representing 97% of inflows—beating out ethereum and other cryptocurrencies.

But that figure is consistently in flux and has changed dramatically in just the past week. Eleven bitcoin ETFs saw a total of $500M in outflows in the past two days—including $1B in withdrawals from Grayscale over the past seven days.

The ETFs, perhaps unsurprisingly, carry many of the speculative tendencies that define the crypto trading space writ large. Bitcoin’s price has fallen by 16% since its record high last week, encouraging outflows from costlier bitcoin ETFs and from the space in general.

“The fact there’s regulated entities providing investment options into bitcoin is something that gives investors confidence, but it doesn’t alter the fundamental nature of bitcoin itself,” Laith Khalaf, Head of Investment Analysis at AJ Bell, told the Financial Times.

To Grayscale CEO Michael Sonnenshein, however, superlative outflows are just a sign that the company’s fees are too high compared to competitors’ bitcoin investment offerings. BlackRock, for instance, saw $527M in inflows over the past week, a sign that its ETF offering is both competitively affordable and successful.

“Of course, we anticipated having outflows,” Sonnenshein said in an interview with CNBC. “Investors have been wanting to either take gains on their portfolio, or arbitragers coming out of the fund, or people unwinding positions that were part of bankruptcies through forced liquidation.”

“What we’ve seen is GBTC continue to trade liquidly with tight spreads, and across a very diversified shareholder base. So we kind of think we’re between the first and the second inning of this,” he continued, adding that Greyscale’s fees will come down through new products and efficiency improvements. “And now we’re kind of starting to move towards that second and third inning, where there’s so much more of the market that still is not yet accessing these products.”

Greyscale’s understanding of pathways to market growth—that crypto-based financial products are only in nascent stages—is a fairly normative statement from any financial CEO, but it may reveal the deeper anxiety surrounding crypto products. Do these ETFs, like the cryptocurrencies undergirding them, require more investors to buy into their vision in order to become successful and profitable?